Navigating the process of securing a business loan can be intimidating, but with the right guidance, you can streamline the experience. At Bridge, our goal is to simplify this journey by connecting you with a network of over 75 diverse lenders through a single request for proposal (RFP) submission. Here’s a step-by-step guide of our RFP form and what to expect after you submit. Although the form is simple, our team highly recommends providing as much detail as possible. This will help our lender network better evaluate your needs.

To prepare for submission, we recommend you have the following information on hand:

- Fiscal year profit and loss and balance sheet

- Historical profit and loss

- Debt schedule

- QuickBooks account information if you have an account

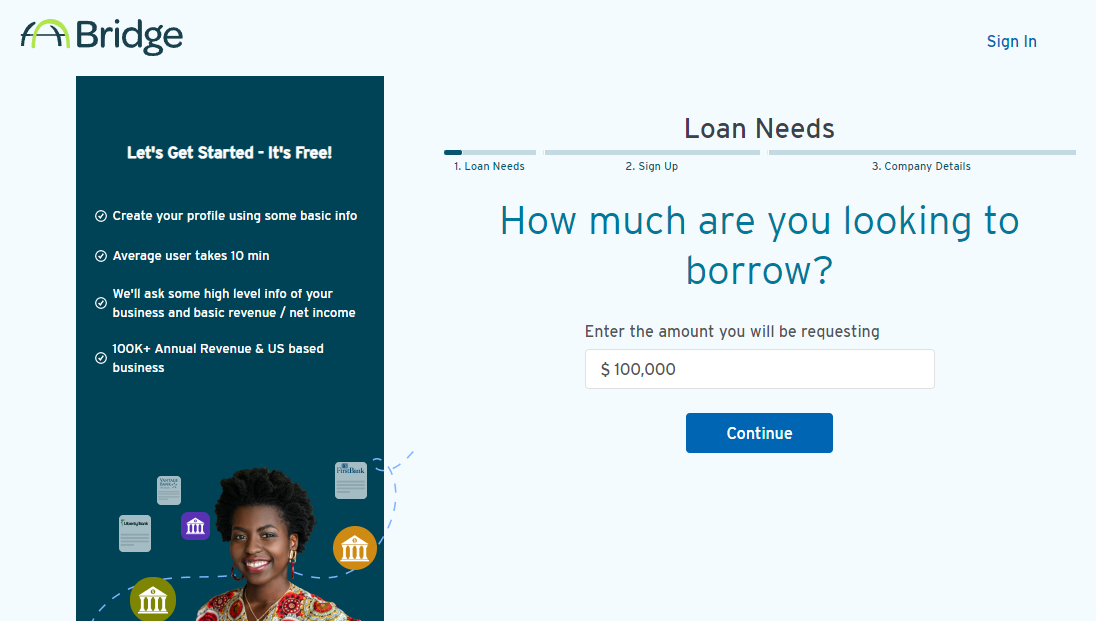

Step 1: Define Your Loan Requirements

How much are you looking to borrow?

- Enter the amount you will be requesting.

- Note: We only accept loan requests greater than $100,000

- What do you need this loan for?

- Select the option that best describes your financing purpose:

- Purchase Inventory, Finance Receivables/ Invoices, Company Acquisition, Purchase Building (that I’ll occupy), Purchase Equipment, Building Improvements or Renovation, Dividend or Distribution, Leasehold Improvements, Legal Expenses, Partner Buyout or Share Repurchase, Purchase Building as an Investment Property, Refinancing (Excluding Commercial Mortgage), Refinancing (Commercial Mortgage), Other Working Capital, Other.

- Provide a detailed description of your loan’s purpose in at least two sentences to help lenders evaluate your needs.

- For example:

- As we expand in retail, we occasionally face periods where our cash flow falls short of what’s needed to purchase raw materials and maintain production levels essential for our growth. This loan would help us bridge this brief gap, ensuring we have sufficient cash flow to cover our inventory needs until our revenue stabilizes.

- For example:

- Refinance existing commercial mortgage coming due in September of this year. I am also looking for an additional $100,000 in working capital for marketing expenses.

- What type of loan are you looking for?

- Choose from Term Loan, Line of Credit, Commercial Mortgage, or select "I’m not sure" if you need guidance.

- If you’re not sure, our team of banking experts can help you determine what type after you submit

Step 2: Create Your Profile

To proceed with your RFP, you’ll need to create a profile on Bridge:

Enter Your Personal Information:

- First name

- Last name

- Phone number

- Work email address

- Password

Identity Verification:

- Choose whether you want to be texted or called a code to verify your identity.

Now you’ve created an account on Bridge, and you’ll use that email and password to log back in next time. Now you will be guided to provide details about your company.

Step 3: Provide Company Details

Basic Information:

- Legal Name: Enter your business name.

- Description: Describe your company in 2+ sentences.

- Website: Enter your company’s website URL.

Address Information:

- Street name & number

- Apartment, Suite #, Unit, Building

- City/Town

- Zip Code

- State

QuickBooks Integration:

Optionally connect your QuickBooks Online account to pre-populate our form. Your information will remain private. You’ll need your QuickBooks Online credentials handy.

- Note: Haven’t updated your QuickBooks recently? No worries, you will still be able to edit the information and control access once connected.

Company Background:

- Founding Year: Enter or select the year your company was founded.

- We only work with businesses that have been established for at least a year.

- Industry: Type or select the industry that best describes your business.

- Employees: Select the number of employees of your business from the given range.

Financial Information:

In this section, we ask for some high-level financial metrics. You will not be uploading financing statements now, that will come later.

- Revenue and Net Income: Provide the most recent fiscal year, month, financial statement type, estimated annual revenue, and net income.

- Recent Financial Performance: Describe your company’s recent financial performance in a couple of sentences.

- Examples:

- Our growth trajectory remains strong, fueled by our expansion in brick-and-mortar retail. We are currently in over 1,000 Target stores and will be adding 200 more in September with our product launch at Walmart Stores. Our sales grew 10% in the last year as we also expanded into a new product line.

- We are currently in a growth stage and anticipate doubling our revenue in 2024, aiming to achieve $100 million by the end of 2025. Our EBITDA has been growing 10% YoY and we have added 20 new employees to the staff.

- Examples:

- Note: If your loan purpose is business acquisition, please ensure you include the financials of the company you are acquiring

Balance Sheet Details:

- Total Assets

- Total Liabilities

- Total Company Net Worth

- Most Recent Total Inventory

- Most Recent Accounts Receivable

- Cash

Primary Owner’s Personal Net Worth:

- Enter your net worth

Due Diligence

- After you submit your RFP you have the option to import financial statements to the portal

- Note: lenders cannot see these financials until you select them as a preferred lender

Step 4: Review and Submit

Congratulations! You’ve completed the RFP form. Review the summary of the information provided and click “Submit”. Lenders will begin reviewing your information, and soon, you’ll be on your way to securing the loan that best fits your business needs.

A member of our team may reach out via email or phone for further clarification on your request to help identify the best potential lenders. Check your spam folders! And be on lookout for a call from Bridge.