Your Single Source for Business Financing

Our capital or our network, we manage your deal from request to funded.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

What financing do you need?

Bridge provides the same simple process for financing $100K to $100M.

Hotel Financing

Fund your hotel acquisitions, renovations, refinances, PIPs, and new construction, with direct lending and capital matched to your property, brand, and timeline.

Learn More

Retail Suppliers

Capital designed for inventory-heavy growth, retailer timelines, and the realities of scaling a consumer brand.

Learn More

We are the capital partner to the brands you trust every day

Terms in 48 Hours • no COST to Use

Unlock the same access to capital that the Fortune 500 enjoys

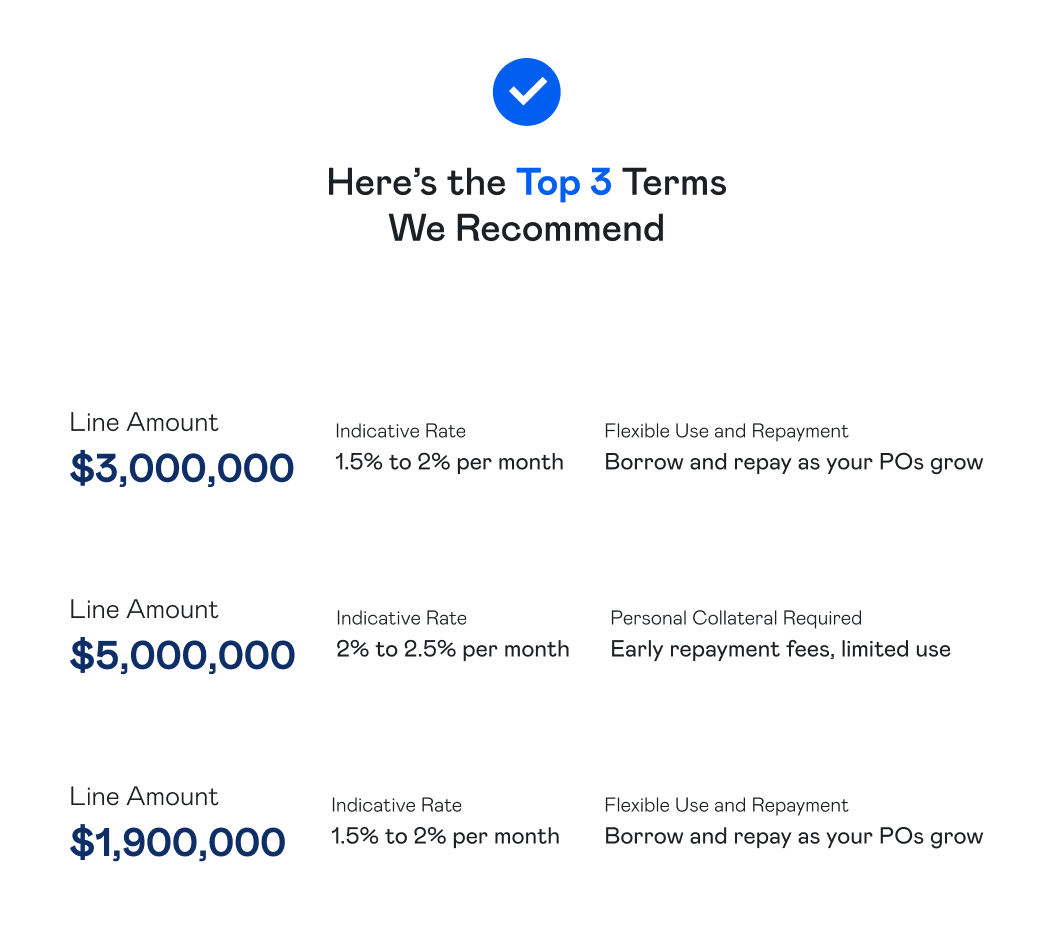

Bridge reviews your needs, structures your financing package, and presents terms, typically within 48 hours of completing your request.

Request Financing

From request to funded in 3 simple steps

No Cost To Use • Terms in 48 Hours

Bridge aligns your loan request with how capital providers are underwriting today, getting you better terms in 48 hours, then drives your deal through to closing.

Step 1

Share basic details

Tell us a few key details about your business, use of funds, and timeline.

Step 2

Review the right offers for your business

Bridge’s technology structures your request for today’s underwriting standards, then we help you choose the best option for your goals.

Step 3

We get it funded

We simplify and manage the underwriting process, so you get capital in hand without the stress.

Hundreds of businesses served with 5-Star reviews

Get the financing your business needs

Get Started